What the INDUSTRY LEADERS are seeing, and you may want to discover yourself.

GOLD is making a comeback – erasing losses endured from the US dollar’s recent bull run. With spot prices reaching a short-term base a couple of hundred dollars below recent all-time highs in the $2,000s, now is the time to take a sharp look at the precious metals market.

A senior market analyst at New York’s OANDA finds that we are “probably seeing gold investors starting to feel a little more positive about scaling back into gold.” However, these investors must think about where to place their capital.

While spot gold is where investors are looking for “safe-haven,” slow-growth investments place their capital, tenured ones recognize an unique moment in history – a once-in-a-lifetime chance to invest in companies with massive potential for growth and profits – at almost-blowout prices.

Quebec Precious Metals Corporation (TSX.V: QPM) is a company perfectly primed in all three factors: located right by one of QC’s largest active gold mines with excellent logistics, closing in on its resource estimate stage, and STILL trading at penny-stock level.

We know what you’re thinking.

“Oh, great. Another junior gold miner.”, right?

Not quite. This isn’t just a run-of-the-mill junior gold miner. It’s a gold-asset consolidation strategy by 3 TSX.V-listed companies. Three companies that saw the potential and managed to get it noticed by possibly the largest gold player in the entire sector.

Curious? Read on.

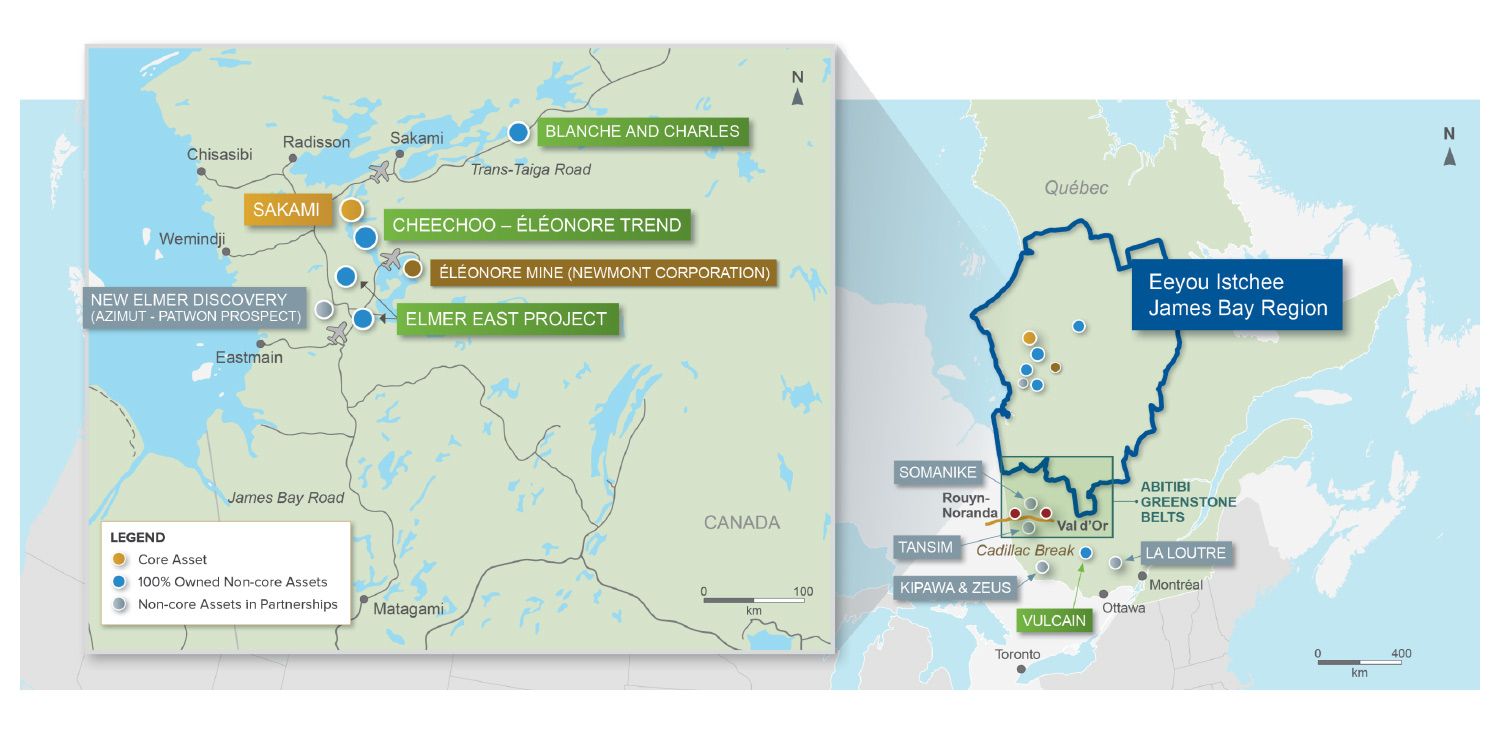

QPM’s Sakami Project, located in the James Bay region right by the prolific Éleonore mine, has such a major potential that it’s caught the attention of its neighbour: Newmont Corporation (TSX: NGT).

Newmont is the world’s largest gold mining company. They also own the Éléonore mine – one of the largest in Québec, and right by QPM’s Sakami.

NEM’s world-class portfolio of assets, prospects and talent is anchored in favorable mining jurisdictions in North America, South America, Australia and Africa. It’s been listed in the NYSE since 1940.

The Éléonore mine is one of the largest operations in the region and is ran by the largest gold company in the world. Enough reasons for that, when you learn that they’re part of QPM’s strong shareholder base, you’ll want to learn why.

So, what’s the secret? Why does such a prominent global player get involved with its small neighbour?

Massive mineral potential. Proven leadership. And extremely favourable logistics.

A Gold Leader’s Investment Parameters – Revealed?

MINERAL POTENTIAL

QPM’s flagship is the 100%-owned Sakami project. The potential is in plain sight: it has an ongoing drilling program, significant grades (1.15g/t Au over 80.1m, including . 2.21 g/t Au over 25 m, 6.40 g/t Au over 13 m, 26.35 g/t Au over 11 m) and well-defined and drill-ready targets.

LOGISTICS

The site’s appeal is enhanced by a reliable, established infrastructure, which allows for year-round access.

AN UNEQUIVOCAL CHANCE FOR EXPLOSIVE GROWTH

QPM’s 2020 is all about determining the mineral resource estimate in its massive position in the highly-prospective Eeyou Itschee James Bay region.

For that purpose, the drilling of their 25,000-meter goal by EOY is ongoing as you read this.

However, the pursuit of that goal has not come without its issues.

This past September, QPM’s drilling plans were shaken up.

To the point that their CEO had to come out and give a statement on the topic.

The reason?

The previously-defined drilling zones were simply… not enough.

Why?

Because of the La Pointe extension discovery and the promising results that came back from its assays.

Which means more drill targets. Which, then again means,

Even MORE potential mineral resources on-site.

QPM CEO Normand Champigny chimed in on the subject: “The discovery of the La Pointe Extension marks a turning point for the company and highlights the strong exploration potential of the Sakami Project. We are pleased with the initial results and are excited to test the continuity of the structure identified at the La Pointe Extension and a new target area uncovered by the IP survey.”

The potential for additional discoveries, aside from their already ambitious exploration targets, are likely part of why Newmont (NYSE:NEM), along with local QC institutions, choose to get a piece of this golden nugget.

However, don’t take our word for it.

Click HERE to see QPM’s corporate presentation. You’ll find all the information we’ve discussed here, and much more.

QPM is trading in the TSX at CA$0.23 – ACT NOW. Don’t miss this golden chance.